QUANTILIA Clarity in Complexity

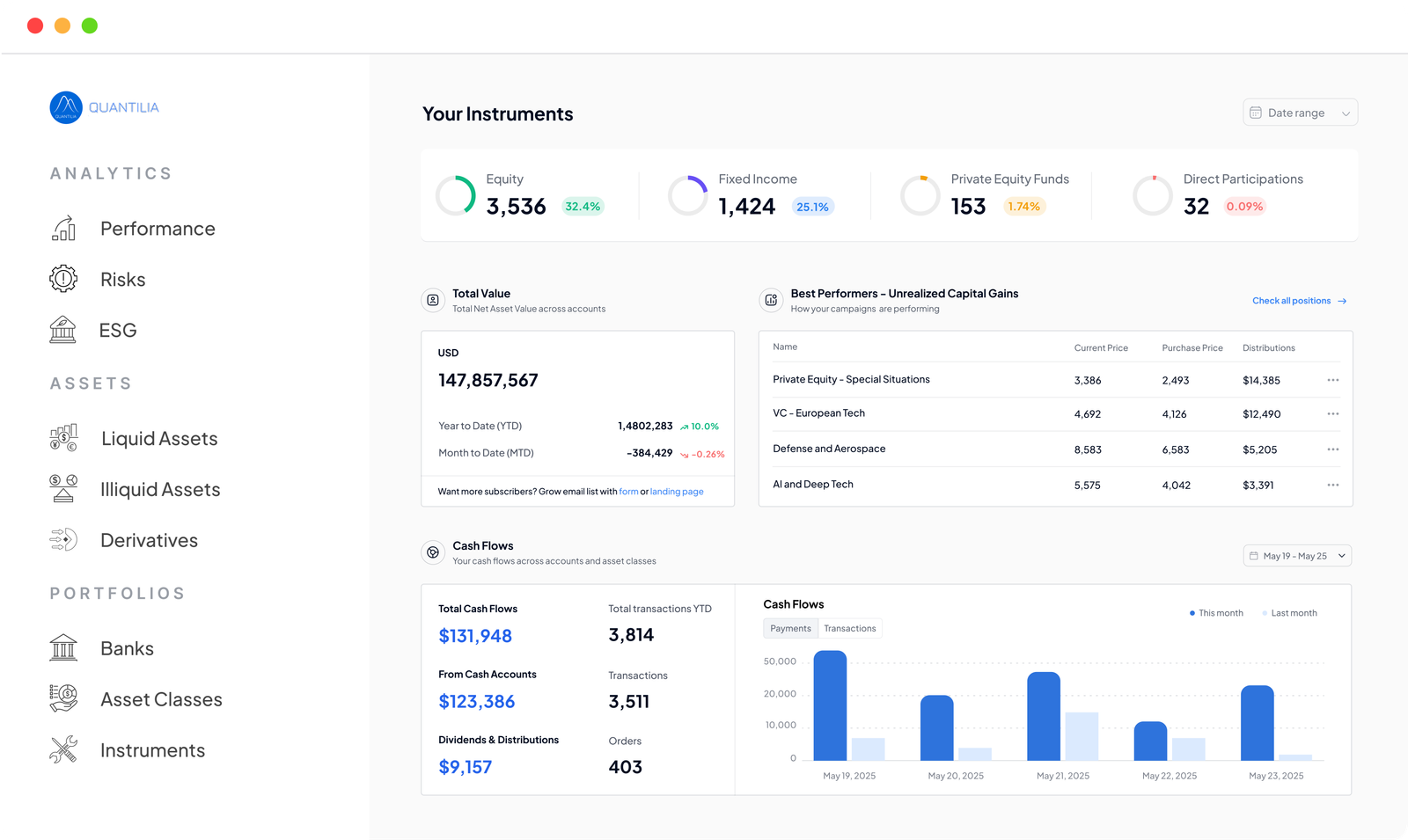

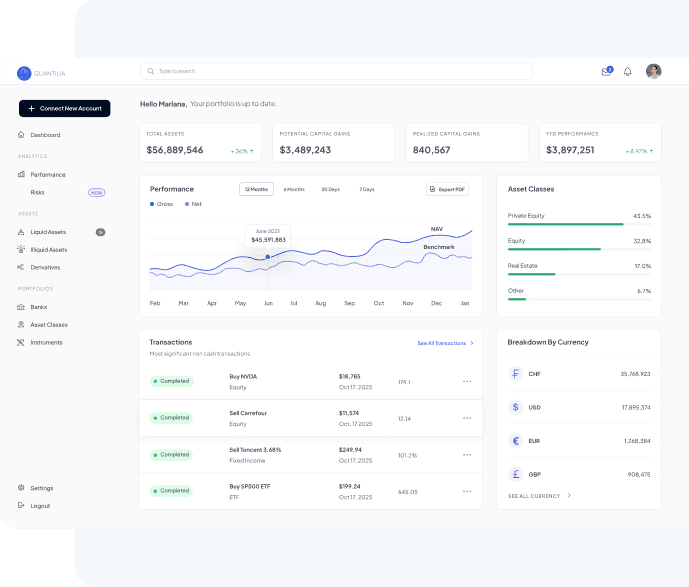

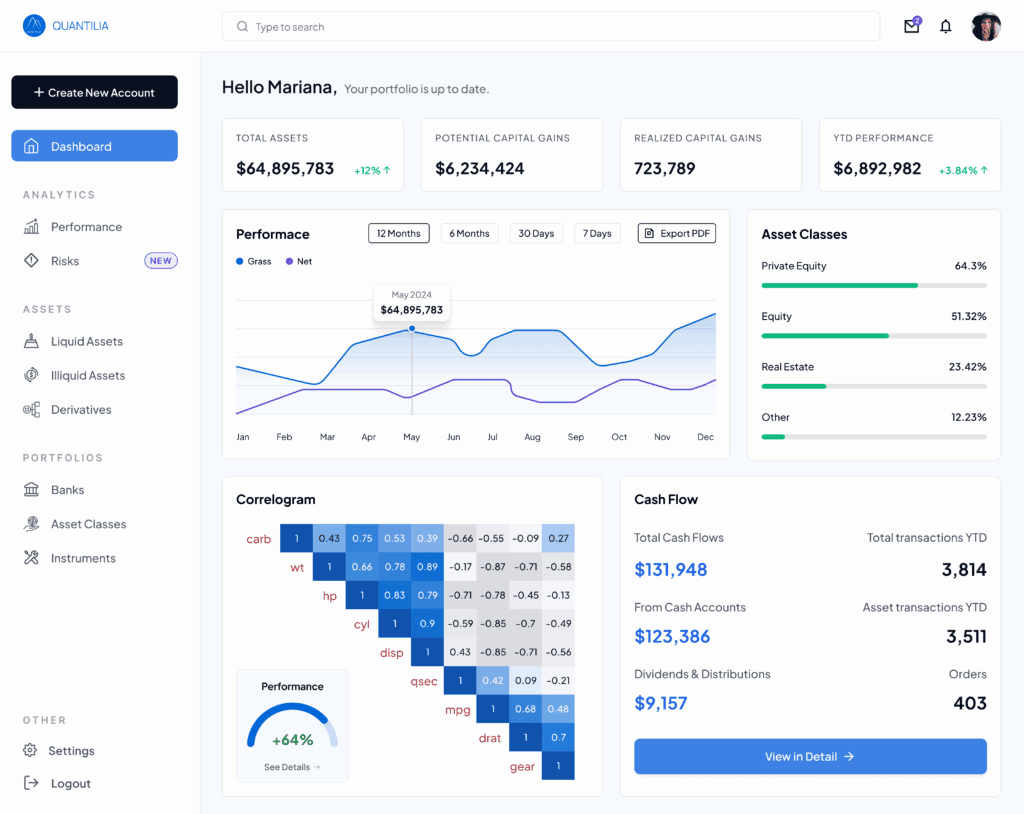

We transform fragmented portfolio data into unified, actionable reporting across all asset classes.

Who we are

Quantilia is a technology company redefining how financial institutions access, manage, and interpret their investment data.

Designed for asset managers, private banks, and institutional investors, our platform provides a comprehensive suite of tools for portfolio monitoring, risk transparency, and advanced reporting.

At the core of every Quantilia solution lies a commitment to data quality — a principle that drives everything we build.

We aggregate, standardize, and reconcile data from multiple custodians and providers to deliver a single, reliable source of truth.

By eliminating discrepancies and manual errors, Quantilia empowers clients to focus on decision-making, not data management.

From structured products to private markets, ESG metrics, and AI-assisted analytics, our technology captures complex investment universes with precision and clarity.

50+

Clients

$ 250B

Monitored

650+

Data partners

5

Countries

Who We Serve

Quantilia combines technological excellence with the agility of a partner who truly understands the operational realities of financial institutions. Each project is led by seasoned managers with deep experience in asset management and reporting, ensuring that every implementation is both technically robust and business-aligned.

From Chaos to Clarity

Ingest from any Source

Custodian banks

Fund managers

Private equity & real estate

ESG providers

Any file format : Excel / PDF / APIs, data feeds,...

Art, collectibles, cryptocurrencies,...

- Extract

- Test

- Categorize

- Standardize

- Label

- Enrich

- Control

- Analyse

Put it to Work

Visualize holdings, performances & risks

Regulatory reports : Solvency, QRT, COREP, CRR3, SFDR, PAI, LEC29,...

Track ESG & carbon exposure

Forecasts & stress-tests

Share reports with your team / board / auditors / clients / regulators

Some of our 500+ Data Partners

What We Do

Some of Our Core Features

Discover the key features that make our CRM: platform powerful, efficient, and user-friendly.

Categorize all flows, calculate ratios, forecast your liquidity needs and report on your illiquid assets positions

Clients Feedbacks

What people say about QUANTILIA

Hear directly from our clients about their experience and the impact we’ve made. Real stories, real results see how we’ve helped them succeed.

The adoption of Quantilia’s custom analytics solution marks the next step in GATE Advisory’s sustained efforts towards offering high-precision investment opportunities to its clientslness truly sets them apart. My go-to for a guilt-free, joyful indulgence!

Swiss Asset Manager

The outsourcing of data collection and the use of your platform provide the teams with substantial relief and efficiency gains, not to mention the significant improvement in the quality of the data they receive.

French Development Agency

Quantilia has enabled us to centralise the entirety of our multi-asset portfolio information within a single, reliable environment. The platform’s capacity to consolidate data from multiple custodians and managers has significantly reduced our operational workload. The quality and consistency of the reporting delivered to our board have improved markedly.

French Pension Fund

Quantilia has provided us with a robust framework for integrating look-through data, ESG indicators and Solvency risk metrics across complex investment structures. The platform’s ability to adapt to our internal methodologies and regulatory constraints has been particularly valuable. It has become a central component of our reporting infrastructure.

European Insurance Group

Quantilia has allowed us to harmonise reporting across a diverse set of client portfolios, each with its own custodial arrangements and asset mix. The platform’s capacity to standardise data and produce coherent, tailored reports has materially improved the transparency we provide to our families. It has become an essential component of our operating model.

Multi-Family Office

Our organisation required a solution capable of delivering precise, confidential reporting while accommodating non-standard asset classes. Quantilia met these requirements with a high degree of rigour. Its customisable dashboards and automated document production have enabled us to enhance internal governance and significantly reduce the time spent on manual consolidation.

Single Family Office (France)

Complete. Reliable. Secure.

Industry-leading standards tailored to your needs.

ISO-27001 certified

GDPR

EU and Swiss based hosting

DORA Compliant

Case Studies

They talk about us